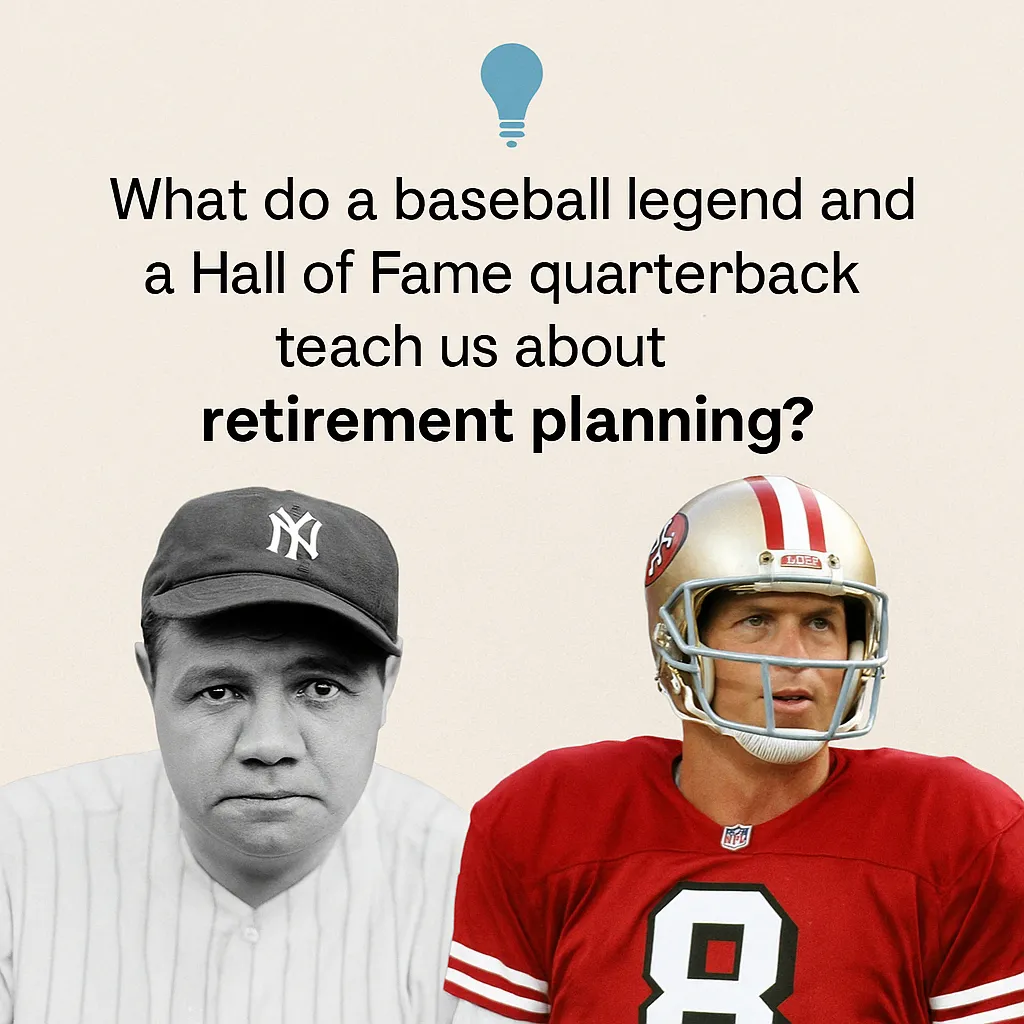

What Do Steve Young & Babe Ruth Know That We Don’t?

When you think of Steve Young and Babe Ruth, your mind probably flashes to epic plays, unforgettable moments, and legendary sports careers. But here's the real plot twist…

💡 Their smartest moves weren’t made on the field.

They were made with their money.

🤔 The Secret Playbook of Legends

So, what do these two icons—decades apart in sports history—have in common?

They both leaned into something most people overlook: annuities.

And not because they had to.

Because they knew something most people still don’t.

🏈 Steve Young’s $40 Million Power Play

Back in the 1980s, when Steve Young signed with the USFL’s Los Angeles Express, he didn’t take his salary as a lump sum. Instead, he chose an annuity—spreading his $40 million contract over nearly 40 years.

Imagine that. While most athletes worried about their short career windows, Steve locked in decades of guaranteed income.

Why?

Because predictable income > flashy paychecks—especially when your playing days are over.

⚾ Babe Ruth: Depression-Proof

Now let’s rewind to the 1930s. The world was drowning in economic chaos, and people were losing everything.

But not Babe Ruth.

Why? He started receiving annuity payments in 1934.

While others panicked, he had a stable income—year after year.

Annuities helped him thrive in a time when even the most successful people were tightening their belts.

💭 So What Do They Know That We Don’t?

It’s simple. They knew that:

📊 It’s not about how much you make—it’s about how smartly you secure it.

Annuities may not be flashy, but they’re financially fearless.

They’re the strategy behind long-term peace of mind, not short-term thrill.

✅ Why Annuities Deserve a Second Look

Whether you’re a sports legend or planning your everyday dream retirement, annuities offer:

✔ Guaranteed lifetime income

✔ Protection of your principal

✔ Tax-deferred growth

They’re not just for the ultra-wealthy—they’re for the ultra-wise.

🧭 Final Thought: Will Your Future Self Thank You?

Steve Young and Babe Ruth weren’t just legends because of what they did on the field—they became icons for how they secured their futures.

The real question is:

What’s in your retirement playbook?

📞 Let’s explore if annuities could be a winning move for your financial game plan.

#FinancialPlanning #MoneyMoves #AnnuitiesExplained #SmartMoney #WealthProtection #GuaranteedIncome #BabeRuth #SteveYoung #FinancialConfidence #LegendaryRetirement #FinancialFreedom

A simple yet powerful way to visualize the relationship between managing responsibilities and building wealth.Click the below button to know more.

Don’t leave your loved ones in uncertainty. Start planning today, and ensure that your wishes are followed and your legacy is protected. You’ve worked hard to build your life, now let’s protect it for the ones you care about most.

When it comes to paying off debt, two popular strategies are the Debt Snowball and Debt Avalanche methods. choosing the right one depends on your personal preferences and financial situation. Click the below button to know more.

The ideas for a comfortable retirement have changed a lot. Understanding how those changes affect you could be the difference between living your dreams and living a long life of uncertainty.Click the below button to know more.